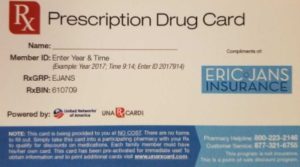

Prescription Discount Cards. You’ve seen them at your local pharmacy, you’ve seen their ads on TV and have even seen apps for them. But what’s the down-low? How do they work and are they legitimate?

What are prescription discount cards?

A prescription discount card is a card that can be used when purchasing drugs at a pharmacy in order to receive a discount. You could think of it as a coupon of sorts. Unfortunately, as we all know, coupons usually come with a hitch or two, but more on that later..

How do they work?

Much like a refinance company, a company called a pharmacy benefits manager (PBM) creates a network of pharmacies that all decide to accept these cards. The PBM negotiates a discount on prescriptions sold in each pharmacy. Discounts are not exactly applied democratically, however. Some pharmacies offer a discount on one drug and other pharmacies offer discounts on another drug while some pharmacies choose not to participate at all. Likewise, some cards like GoodRx are accepted at one pharmacy and some cards like US Pharmacy Card may be accepted at another pharmacy.

Are they worth trying?

There are situations where a prescription discount card can be beneficial.

Generally speaking, if you have a health insurance plan with pharmacy benefit, your

co-pays are most likely less expensive using your insurance plan than with the discount card. However, if you fall into one of the categories below, then a prescription discount card may be worth a try:

1. You do not have health insurance.

2. You have health insurance but it does not cover your prescriptions.

3. You have health insurance but are still paying way too much for your prescriptions.

What to look for

1. Most cards average a 15-18% discount, so look for cards that offer a minimum of 60,000 locations and a minimum 35% discount.

2. Free cards. There is no need to pay for these cards and most likely, it would not be worth it to do so.

3. Select wisely. Talk to your pharmacist for a recommendation on the best cards. Determine which cards will save you the most money at the pharmacy you frequent and the drugs you purchase.

4. Test the card’s customer service. Go ahead and try out the helpline number on your card to see how helpful they actually are. This is a good indication of the kind of company you’re dealing with.

5. Cards that require no registration. Don’t be mass marketing bait. Registering for these cards is completely unnecessary and will only result in more junk mail and telemarketer calls.

Be Wise

I love a great bargain. In fact, one of my favorite things to do is help my clients save save money. There are certainly cases where a prescription savings card can provide significant benefits. But they are not always your best option. If you have prescription needs, it’s important to consider the following options first:

1. Upgrading your health insurance plan to one that provides solid prescription benefits.

2. Considering lower cost drugs or generics. There are several ‘big box’ retailers (Walmart, Target and Costco, for example), that have $4 generics programs.

3. Be aware that there are situations where purchasing prescriptions with a prescription discount card can actually be more expensive than paying cash. Talk to your pharmacist about your options before you buy.

4. Don’t assume that because your favorite pharmacy accepts your prescription discount card and provides a discount on your prescription, that every other pharmacy will provide the same (not better) discount. Call around and find out which pharmacies can provide the deepest discounts.

5. Make sure to look online at GoodRx.com for the best prices locally as well as coupons.

Prescription discount cards can have their benefits, but always do your homework and consider all of your options. As always, I’m here to help and provide input based on my expertise.